Page 48 - Central Savannah River Area - Seniors Resource Directory

P. 48

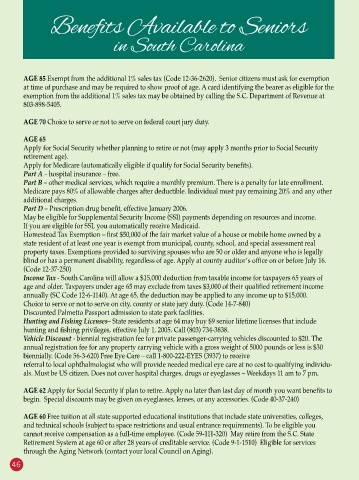

Benefits Available to Seniors

in South Carolina

AGE 85 Exempt from the additional 1% sales tax (Code 12-36-2620). Senior citizens must ask for exemption

at time of purchase and may be required to show proof of age. A card identifying the bearer as eligible for the

exemption from the additional 1% sales tax may be obtained by calling the S.C. Department of Revenue at

803-898-5405.

AGE 70 Choice to serve or not to serve on federal court jury duty.

AGE 65

Apply for Social Security whether planning to retire or not (may apply 3 months prior to Social Security

retirement age).

Apply for Medicare (automatically eligible if qualify for Social Security benefits).

Part A – hospital insurance – free.

Part B – other medical services, which require a monthly premium. There is a penalty for late enrollment.

Medicare pays 80% of allowable charges after deductible. Individual must pay remaining 20% and any other

additional charges.

Part D – Prescription drug benefit, effective January 2006.

May be eligible for Supplemental Security Income (SSI) payments depending on resources and income.

If you are eligible for SSI, you automatically receive Medicaid.

Homestead Tax Exemption – first $50,000 of the fair market value of a house or mobile home owned by a

state resident of at least one year is exempt from municipal, county, school, and special assessment real

property taxes. Exemptions provided to surviving spouses who are 50 or older and anyone who is legally

blind or has a permanent disability, regardless of age. Apply at county auditor’s office on or before July 16.

(Code 12-37-250)

Income Tax - South Carolina will allow a $15,000 deduction from taxable income for taxpayers 65 years of

age and older. Taxpayers under age 65 may exclude from taxes $3,000 of their qualified retirement income

annually (SC Code 12-6-1140). At age 65, the deduction may be applied to any income up to $15,000.

Choice to serve or not to serve on city, county or state jury duty. (Code 14-7-840)

Discounted Palmetto Passport admission to state park facilities.

Hunting and Fishing Licenses– State residents at age 64 may buy $9 senior lifetime licenses that include

hunting and fishing privileges, effective July 1, 2005. Call (803) 734-3838.

Vehicle Discount - biennial registration fee for private passenger-carrying vehicles discounted to $20. The

annual registration fee for any property carrying vehicle with a gross weight of 5000 pounds or less is $30

biennially. (Code 56-3-620) Free Eye Care – call 1-800-222-EYES (3937) to receive

referral to local ophthalmologist who will provide needed medical eye care at no cost to qualifying individu-

als. Must be US citizen. Does not cover hospital charges, drugs or eyeglasses – Weekdays 11 am to 7 pm.

AGE 62 Apply for Social Security if plan to retire. Apply no later than last day of month you want benefits to

begin. Special discounts may be given on eyeglasses, lenses, or any accessories. (Code 40-37-240)

AGE 60 Free tuition at all state supported educational institutions that include state universities, colleges,

and technical schools (subject to space restrictions and usual entrance requirements). To be eligible you

cannot receive compensation as a full-time employee. (Code 59-111-320) May retire from the S.C. State

Retirement System at age 60 or after 28 years of creditable service. (Code 9-1-1510) Eligible for services

through the Aging Network (contact your local Council on Aging).

46