Page 7 - S&D Real Estate

P. 7

INDUSTRY NEWS

Updates on NAR Policies and Mortgage Rates

The real estate market in 2025 continues to evolve, driven by key

changes from the National Association of Realtors (NAR) and

fluctuating mortgage rates. These developments are reshaping the

buying and selling process, making it essential to stay informed as

you navigate the market.

NAR Policy Changes and Shared Commissions

In the wake of recent antitrust lawsuits, the National Association of

Realtors (NAR) has implemented several policy changes aimed at

enhancing transparency and consumer choice. One of the most

notable updates is the elimination of mandatory compensation

offers to buyer agents in Multiple Listing Service (MLS) listings.

This change allows for more flexible and negotiable commission

arrangements, empowering buyers and sellers to work with agents

who align with their goals. At S&D Real Estate, we’ve long

embraced a transparent commission model. Our policy of always

sharing commissions ensures fairness and clarity for every

transaction. If we work with another agent, our commission is

capped at 3%, providing additional value to our customers without

sacrificing quality service.

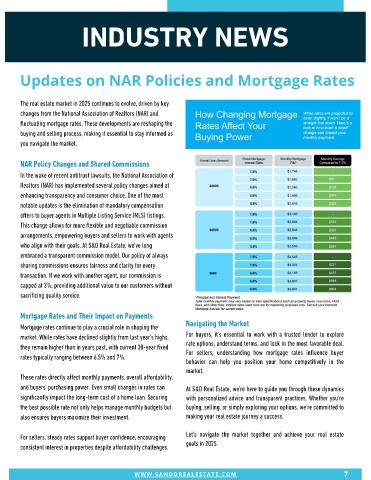

Mortgage Rates and Their Impact on Payments

Navigating the Market

Mortgage rates continue to play a crucial role in shaping the

For buyers, it’s essential to work with a trusted lender to explore

market. While rates have declined slightly from last year’s highs,

rate options, understand terms, and lock in the most favorable deal.

they remain higher than in years past, with current 30-year fixed

For sellers, understanding how mortgage rates influence buyer

rates typically ranging between 6.5% and 7%.

behavior can help you position your home competitively in the

market.

These rates directly affect monthly payments, overall affordability,

and buyers’ purchasing power. Even small changes in rates can At S&D Real Estate, we’re here to guide you through these dynamics

significantly impact the long-term cost of a home loan. Securing with personalized advice and transparent practices. Whether you’re

the best possible rate not only helps manage monthly budgets but buying, selling, or simply exploring your options, we’re committed to

also ensures buyers maximize their investment. making your real estate journey a success.

Let’s navigate the market together and achieve your real estate

For sellers, steady rates support buyer confidence, encouraging

goals in 2025.

consistent interest in properties despite affordability challenges.

WWW.SANDDREALESTATE.COM 7